|

Not everybody requires an SR-22/ FR-44.: DUI convictions Reckless driving Crashes triggered by uninsured vehicle drivers If you need an SR-22/ FR-44, the courts or your state Electric motor Lorry Department will certainly notify you. We will certainly review the protections on your plan and begin the process of submitting the certification on your behalf. Is there a charge linked with an SR-22/ FR-44? A filing cost is billed for each private SR-22/ FR-44 we submit. If your partner is on your policy and both of you require an SR-22/ FR-44, after that the filing cost will be billed twice. Please note: The charge is not consisted of in the rate quote since the declaring fee can vary.

For how long is the SR-22/ FR-44 valid? Your SR-22/ FR-44 needs to stand as long as your insurance plan is energetic. If your insurance coverage plan is canceled while you're still needed to bring an SR-22/ FR-44, we are required to notify the correct state authorities (insurance). If you do not maintain continual coverage you could shed your driving advantages. Non-owner automobile insurance coverage is insurance policy for individuals that don't own an automobile yet sometimes drive somebody else's automobile. You may gain from this sort of insurance coverage if you usually rent a vehicle, obtain a friend's car, or use car-sharing solutions. ignition interlock. Discover just how non-owner cars and truck insurance policy works, what it covers, what it does not cover, and why you may require it. The smart Trick of Non-owners Auto Insurance & Sr-22s - Faqs - David Pope That Nobody is Talking About

This kind of insurance coverage is best for those that regularly lease or obtain cars and trucks. Non-owner insurance protection starts after the owner's insurance policy coverage has been exhausted. The financial savings might not accumulate if you're driving an obtained or rented out vehicle just a few times monthly. Interpretation and Instance of Non-Owner Vehicle Insurance Non-owner automobile insurance coverage is a sort of individual auto insurance that covers motorists that don't possess the auto they're driving. SR22 insurance coverage won't automatically drop when you no much longer require it. You must ask your insurance firm to remove the filing from your car policy. Call your state division of electric motor lorries to determine the length of time you'll need to lug SR22 insurance coverage. You'll require it for 3 years in most states. You might be called for to have non-owner car insurance coverage in some particular scenarios, such as if you have a prior background of DUIs. What Does Non-Owner Cars And Truck Insurance Cover?

Non-owned plans and also non-owner policies are not the very same. Non-owned plans are business car protection that safeguards business owners. These are used when staff members drive their very own cars for organization objectives, such as for sale telephone calls or duties. Do I Need Non-Owner Auto Insurance Coverage? Non-owner insurance policy isn't a common plan. You Regularly Lease Cars or Use Car-Sharing Solutions Vehicle rental companies and car-sharing solutions such as Zipcar should offer the state's minimum quantity of obligation security. credit score. This is required for their autos to be able to run lawfully when traveling. That might not be enough to cover severe crashes. Non-owner Sr-22 Insurance Can Be Fun For Everyone

Non-owner insurance policy can be a cost-efficient choice. You may be able to decrease any kind of obligation coverage that the rental firm intends to bill you for if you have it, relying on the state you're in. It can additionally depend upon the firm you're renting from. You still may wish to secure physical damage insurance coverage if you get a non-owner policy because you commonly rent out cars. You're Between Vehicles You might believe that you do not require insurance policy coverage if you have actually sold a car and you're waiting to acquire another, yet carriers like to see that you have not had any type of gaps in insurance coverage. "Some individuals do choose to buy the non-owner plan to maintain continuous insurance coverage as well as have the most effective prices offered when purchasing a brand-new auto," Ahart said. Ask what the non-owner plan covers and also about any type of coverage limits (dui). Find out whether you can include added types of protection. Not all insurance firms providing non-owner auto insurance coverage sell it in every state. Calling an independent representative could assist in saving you time looking. Policy prices will primarily depend upon the quantity of responsibility insurance coverage you choose. Often Asked Concerns (FAQs) How much is non-owner auto insurance?, and your insurance coverage restrictions will all affect your non-owner vehicle insurance price. Where can I obtain non-owner automobile insurance policy? Most insurers sell non-owner automobile insurance coverage, however insurance coverage might not be offered in your state. Call an insurance policy agent or your insurance coverage provider straight. You normally can not select this alternative with an on the internet quote device. auto insurance. Which is less expensive, non-owner or non-drivable cars and truck insurance coverage? These insurance products are for 2 different functions. Getting My Get Sr22 Insurance In Washington State Financial ... To Work

Non-owner automobile insurance coverage wouldn't be suitable if you wish to insure an auto that isn't drivable - insurance group. Non-owner SR-22 insurance is a kind of vehicle insurance policy that is designed for chauffeurs that are needed to have SR-22 insurance coverage however do not have an auto. You may have to get one of these plans in order to restore your driving advantages after a license suspension. Although a lot of insurance companies can in theory supply you SR-22 insurance without an automobile, you may need to choose an insurance company that specializes in giving policies for high-risk motorists. We discovered that The General, Safe, Automobile and Straight Car are great firms to obtain quotes from, as they concentrate on covering high-risk chauffeurs and will likely have the ability to use low-cost non-owner SR-22 coverage. How to obtain inexpensive non-owner SR-22 insurance coverage Non-owner SR-22 automobile insurance policy is typically considerably less costly than a regular plan (vehicle insurance). The most effective way to locate economical non-owner SR-22 insurance policy is to contrast rates from nonstandard insurance firms, such as The General, Safe, Car and Straight Automobile. Unlike other big auto insurance firms such as State Ranch or Allstate these business don't shy away from supplying insurance coverage to drivers who might be thought about. A non-owner SR-22 plan does not cover physical problems like accident or comprehensive insurance policy does, so your plan won't cover the problems caused to any auto that you drive. Does non-owner SR-22 cover any kind of automobile I drive? When you obtain non-owner SR-22 insurance policy, it covers any type of auto you drive because the plan is taken into consideration an operator's plan. Not known Facts About Sr-22 Insurance- What Is It And How Does It Work? - Geico

Non-owner SR-22 insurance covers you if you enter a crash while driving a good friend's auto or a vehicle you have actually rented. These policies are thought about secondary coverage, implying that the plan only kicks in as soon as the primary insurance plan's limits are tired. Claim you enter a mishap while driving a buddy's car and also trigger residential property damage for which you are verified liable (sr22 insurance). How do you get a non-owner SR-22 insurance policy quote? The ideal method to get a non-owner SR-22 insurance policy quote is to call individual insurance business or representatives. Worth, Penguin checked numerous national insurers and located some did not offer SR-22 insurance in particular states. Progressive Direct did not use them at all, however claimed regional representatives might possibly use those policies. As well as several regional Modern companies we contacted Chicago and New York did not offer them to brand-new clients. Below are telephone number for a few of one of the most noticeable nonstandard car insurance providers:. What is Non-Owner SR22 Automobile Insurance? If you do not own a cars and truck, you will certainly still require to purchase this kind, although it will then be a non-owner SR22 type, also referred to as a driver or named-operator plan. Unknown Facts About Non-owner Sr-22 Insurance Explained

What is Consisted of in a Non-Owner SR22? Non-owner SR22 includes basic responsibility insurance policy, yet does not consist of accident protection. You are not covered, but you are shielded from obtaining a ticket or permit suspension you would receive if you were driving without this insurance coverage.

You can either Obtain a quote today online or if you would love to talk to among our licensed representatives, give us a phone call to obtain established up keeping that policy at 888-449-0171. It only takes a few mins to set up your policy and ensure you are covered. sr22. Specialist Suggestions, Andrew Head, Associate Professor of Money at Western Kentucky University, Bowling Environment-friendly, KYWhile all motorists are required to carry certain minimum responsibility insurance policy restricts to be able to drive, people who have actually devoted significant driving offenses (DUI, negligent driving, multiple at-fault crashes, driving without insurance and/or on a suspended certificate) might be called for to submit an SR22 with their DMV in order to maintain their permit, despite whether they possess a car."Failing to bring liability insurance on your car, A sentence for driving without insurance, Driving without insurance and being associated with a car mishap, DUI, drunk driving or other significant alcohol offense sentences, Serious relocating offense (such as negligent driving) convictions, Accumulating way too many DMV factors, Being labelled a habitual traffic wrongdoer, Needing to get a challenge or probationary permit (while certificate is suspended)Renewing your license after a suspension or cancellation, Just how does non-owner SR-22 auto insurance work? An SR-22 is the form you submit to verify economic duty and also the non-owner plan is the insurance policy you may need if you do not have Click here! an auto. sr22 insurance. States can mandate non-car proprietors to acquire auto insurance as well as carry an SR-22 to confirm monetary duty. That's since state agencies are conscious that it's feasible for these people to be negligent and also damage various other people and also their home while driving, also if they don't have the cars and truck they're operating - driver's license.

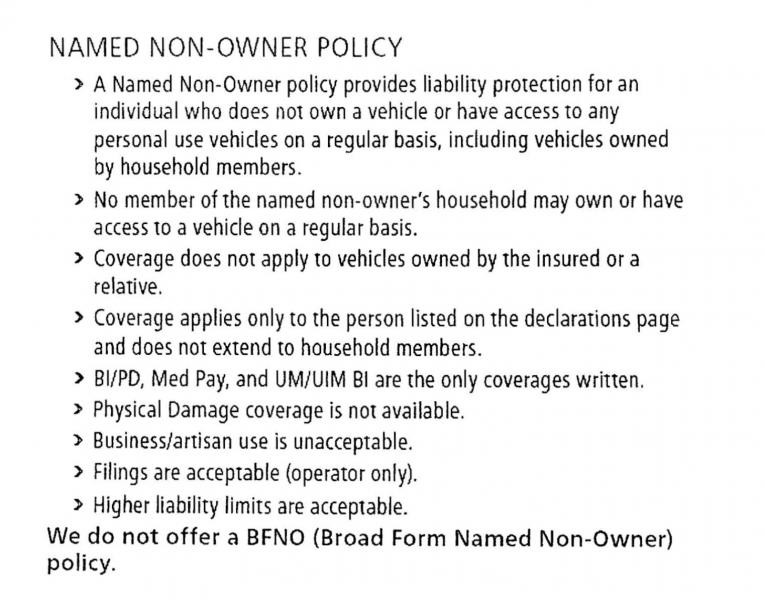

Obtaining SR22 insurance without an automobile - frequently asked question's, To purchase a non-owners plan, you must first fulfill certain conditions. An insurer will normally require that: You have a legitimate vehicle driver's license. You do not have a vehicle. Some insurers likewise need that nobody in your house owns an automobile which you do not have regular access to a vehicle. The Basic Principles Of Cheap Non-owner Car Insurance

Not all providers offer non-owner protection. You'll next off need to have an SR22 submitted in your place. The insurance provider will certainly do this for you. Car insurance provider can just submit an SR-22 after you have acquired at the very least the state-mandated protections as part of your non-owner car insurance plan. The time duration varies, however many typically, it's for 3 years. A non-owner insurance coverage will typically cost a lot less than a proprietor's plan by itself, but with an SR22, it will cost far more. The typical price of a non-owners plan with an SR22 for one DUI sentence is $1,752, based upon a rate evaluation by Senior Customer Expert Dime Gusner. According to Certified Economic Coordinator and professor, Andrew Head there are some simple methods to prevent needing an SR22 - liability insurance."Identify initially that the requirement of an SR22 is no trivial thing; the state is needing this 'extremely verification' of coverage since you have been considered really high threat. This usually included driving in a manner in which puts other individuals's lives at risk. Keep sufficient auto insurance policy coverage as well as drive sensibly. If you are currently in this circumstance, utilize it as a chance for a second opportunity at liable driving.

0 Comments

The regular size of time is for 3 years however might be as several as five (no-fault insurance). If a motorist is needed to preserve an SR22, the certificate needs to indicate that the corresponding insurance policy covers any type of vehicles that are registered under the motorist's name as well as all autos that the chauffeur routinely runs. If that exact same vehicle driver, however, owns a vehicle or has normal accessibility to an automobile, he would certainly require to submit a non-owners SR22 certification. This offers the motorist insurance coverage whenever he is permitted to drive an automobile not his own. The price of an SR22 differs in between insurer. Insurance companies that do supply SR22 insurance coverage have a tendency to do so at a high price. SR22 insurance policy clients also unavoidably pay higher premiums for their minimum responsibility coverage. When first bought to get an SR22, a person will likely first call their present vehicle insurance provider. As soon as that occurs, it, however, notifies the service provider to the truth that a significant event has taken place. division of motor vehicles. The insurance provider will certainly proceed to access the DMV document to check out why the motorist requires the certificate. If the plan is canceled, the driver will certainly be forced to find an alternate alternative. A driver is not required to get an SR22 from their current automobile insurance coverage business. Some Known Incorrect Statements About Aflac - America's Most Recognized Supplemental Insurance ...

Usually, a motorist is required to have an SR22 on apply for 3 years after a certificate suspension because of DUI. The original certification will remain on file with the DMV as long as either the car insurance coverage business or the driver does not cancel the policy. There is no need to re-file annual. sr-22. After encountering apprehension, court dates, and frustrating needs from the DMV, the last point they wish to do is bargain with an insurance representative. Fortunately is that there are choices. Agencies are around that can help you locate the most effective prices for SR22 insurance policy. Relax Insurance is the SR22 Leader in The Golden State.

The typical yearly price of automobile insurance after filing SR22 might be $2,531 for full coverage, as well as $1,079 for the minimum called for insurance coverage, a boost of $473. underinsured. At AAA, SR22 insurance coverage rates are rather inexpensive as compared to others are rather reasonable Required an AAA sr22 insurance policy The Average month-to-month expense for a 45-year-old with a DUI is $167 each month. 2/5 score from Purse, Hub, J.D. Power: 4. BBB: A+ While every auto insurance provider is most likely to boost your prices after you drive drunk (DUI), AAA SR22 insurance coverage prices are cheaper than most others. Nonetheless, you'll intend to try to find business that offer the tiniest rate boost after a DRUNK DRIVING, those with big discounts, as well as those that concentrate on providing insurance coverage to risky motorists. Does AAA use SR22 insurance policy? AAA only provides SR22 insurance policy to its members. Best Sr-22 Insurance Options For 2022 - Benzinga Things To Know Before You Buy

You have been suspended/revoked as a result of a court sentence, build-up of points or some other administrative activity - which needs you to prove to the State of Nebraska that all cars (cars and truck, pickup, van, bike, and so on) you own are guaranteed. If you do not have any kind of automobiles, you need to buy a non-owner or driver plan. This is the only form of proof of insurance policy that will be accepted. It is responsibility to inform your insurer, as quickly as possible, that you an SR-22 filing. You or your insurance provider will need to mail or directly supply the SR-22 filing to this workplace for review - unless the insurance policy company can electronically submit the filing (which is a computer system to computer transfer of details). Texas SR22 Insurance Coverage Questions and Responses The state of Texas needs an SR22 filing if you have actually been driving without insurance or other offenses such as driving under the influence of alcohol. What if I Don't Own an Auto, Can I Still Get an SR22? What's the FASTEST Method to Get Your Texas Permit Restored? I Allowed My SR22 Insurance Policy Gap. What Now? If you have terminated your vehicle insurance coverage with the SR-22 develop the state will certainly be alerted immediately by the insurance coverage business. Your driver's permit may be suspended again and the suspension duration might start over again. Texas SR22 Insurance Coverage Requirements When you submit SR22 insurance coverage in Texas the state requires that the minimal responsibility restrictions be in force on the plan for 2 years. The minimal obligation insurance policy limitations are: $30k Per Individual Physical Injury $60k Per Crash Bodily Injury $25k Building Damages While these limitations are minimal they are hardly ever recommended levels of insurance coverage. Examine This Report on Find Cheap Sr22 Insurance Quotes – (How To Keep It ...

02 or greater CDL chauffeurs = BAC. Your vehicle drivers license will certainly be suspended for a minimum of 90 days however no even more than 1 year. The rejection of this examination will certainly revoke your permit and a momentary permit will certainly be issued. A Texas SR22 will certainly be needed. Texas IID (Ignition Interlock Device) An ignition interlock tool is needed when a chauffeur should preserve an interlock certificate. This type of permit accredits the motorist to run an automobile outfitted with an IID. Right here are some accepted installment centers: Life, Safer Interlock Intoxalock Do not remove the set up device before your suspension period as it will need you to begin the suspension over once again - insure. At American Auto Insurance, we obtain a whole lot of questions from prospective clients about SR-22 insurance. We prepared this guide to assist our existing customers, potential clients, as well as anyone else interested in discovering a little bit more about SR-22 insurance coverage (coverage). The Illinois Secretary of State's office will notify you if you need an SR-22. Get in touch with an automobile insurance coverage company to obtain your SR-22 insurance policy quotes. Know that not all insurer supply SR-22 insurance policy, so you'll need to locate one that does. American Car Insurance coverage gives cheap SR-22 insurance coverage in Chicago & Champaign. deductibles. Rumored Buzz on Sr 22 Insurance : How Much Does It Cost

At American Automobile Insurance policy, we use electronic filing to ensure your SR-22 is done swiftly and quickly. You will have your vehicle driver's license and vehicle enrollment (if relevant) reinstated. This suggests your vehicle insurance plan must continually be current and paid. If your plan expires or there is a gap in your insurance coverage, your automobile insurance coverage provider is called for to alert the state (car insurance). The state can then revoke or suspend your driving opportunities, and you will certainly need to start the procedure over again. The Assistant of State will certainly verify the down payment by providing you a certification. An actual estate bond or guaranty bond are other options to SR-22. Non-owner SR-22 insurance, on the various other hand, will certainly cover you as a motorist of any type of vehicle you do not own, such as an auto you lease or obtain - division of motor vehicles. This way, you can comply with Illinois legal demands while still driving someone else's vehicle! It is worth stating that a non-owner SR-22 insurance coverage expenses significantly less than other policies considering that it only covers an individual for obligation. A non-owner policy might not cover the lorry owned or often used by the convicted motorist. Although the danger to the lorry you are driving remains, the higher limits you purchase for a non-owner policy to cover will give you greater guarantee in the instance of a pricey crash. Getting My Sr-22 Insurance - Safeauto To Work

Info Concerning How to Get Affordable SR22 Insurance Coverage Prices Estimate Under $7/Month (Mon-Fri, 8am 5pm PST) for a or submit this form: Components, SR-22 is a form which vouches for the insurance coverage provided by an insurance provider - sr22 insurance. It can likewise vouch for the uploading of individual public bonds. In the latter instance, it confirms to the minimal responsibility coverage for the driver or the vehicle enrollment. In specific states it is called for that an SR-22 is brought by the motorist or in the lorry which is registered. This is a requirement if the licensee has currently been cited for lapses in protection or a DRUNK DRIVING. This kind of insurance coverage also attests to have responsibility coverage or operator liability protection. It is likewise called for to obtain a license back after it has actually been suspended as a result of a lapse in protection. Many states need that the insurance provider give this type in a prompt fashion to upgrade protection - bureau of motor vehicles. There are online types such as the form you see over this web page where you will simply fill one kind and also you will certainly obtain various quotes from the. Every person makes blunders in life. Some people have trouble with their driving record as well as have lost their license at some time or an additional. If your permit was suspended, after that you will be called for to acquire an SR-22 insurance kind before getting your license restored by the Division of Electric Motor Autos. If you received a DUI you will certainly be called for to get this type to reinstate a suspended permit. dui. If you are needed to get this kind your insurance coverage will certainly cost even more than vehicle drivers with excellent records. SR22 Type, However, you ought to still check out completely insurance policy prices rather than going for the least pricey answer. Some Known Incorrect Statements About What Is Non-owner Car Insurance? - The Balance

If you are needed to get this type as a result of a DUI sentence it will cost you greater than if you were required to get the type as a result of unpaid vehicle parking tickets. You will require to buy responsibility coverage for a cars and truck which you own if you need to get an SR-22 filing. If you have lately had your permit put on hold or you are thought about a "high risk" chauffeur, yet you do not have a cars and truck, you can still buy this kind of insurance coverage under the heading "non-owner protection". This indicates that if you rent out a car or borrow an automobile from your good friend, you still have the insurance coverage you are lawfully required to have (driver's license). Challenging, however possible (motor vehicle safety). (Mon-Fri, 8am 5pm PST) for a or fill up out this form: Most of the time you will certainly discover that you need this insurance when you are going to an administrative court hearing after you have had your certificate eliminated or at encountering a probationary driving duration. At this point, you, as the vehicle driver in concern, have to alert your insurance policy company that the court has actually made this request. At this factor your vehicle insurance coverage will file the form formally with your state DMV on your behalf. Digitally sent forms are refined much faster than snail mail. Keep in mind to request this from your cars and truck insurance coverage promptly after a judge or court has asked due to the fact that there are state target dates for processing it, and if the DMV does not process it on time because they obtained it late, you are the one who obtains penalized. You might also have to begin the SR-22 process all over once more. Try to recognize any kind of other parameters that govern your SR-22. 3 The filing procedures for the SR-22 and also FR-44 are similar in many methods (vehicle insurance). Several of the important points they share include4,5,6: FR-44s are normally called for through court order, or you can validate your need for one by calling your regional DMV - motor vehicle safety. Your automobile insurer will submit your FR-44 on your behalf with the state's automobile authority (ignition interlock). For context, the minimum liability protection for a regular driver is only $10,000 for bodily injury or fatality of someone. deductibles. 7 Where to get an SR-22 If you assume you require an SR-22, check with an insurance agent (liability insurance). They'll have the ability to guide you via the whole SR-22 declaring procedure and also see to it you're meeting your state's insurance policy guidelines - liability insurance. An SR-22 isn't actually auto insurance coverage. SR-22 is a type your insurance provider sends out to the state's DMV revealing that you lug the minimum necessary Responsibility insurance coverage. deductibles. Normally, an SR-22 is submitted with the state for 3 years.

You may locate yourself in a circumstance where you're required to send an SR22 to your state - insurance group. It's nothing elegant, just a type that states you have actually acquired the automobile insurance policy protection needed by your state (sr-22 insurance). The Ultimate Guide To The Traffic Offender's Guide To Insurance - The ...

Is an SR22 proof of insurance coverage? You can obtain the kind by getting in touch with a vehicle insurance company in the state where you call for insurance. Oftentimes, filing an SR-22 insurance policy certificate with the state is the only point standing in your way of obtaining your drivers license reinstated. division of motor vehicles. In other situations, there may be extra requirements, such as going to a driver's program or alcohol understanding courses prior to you can get your license back. You can obtain the sphere rolling, however, by starting the procedure of discovering SR-22 insurance. Not all insurance firms offer SR-22 insurance coverage, however there are plenty who do, so do not obtain inhibited (driver's license). This is since whatever created the state to need you to bring an SR-22 certification puts you in the category of a risky vehicle driver, as far as the cars and truck insurer is worried. The actual declaring cost for the SR-22 certification is in between $15 to $25. The pricey part is the responsibility insurance policy that accompanies being called high threat (underinsured). Exactly how Lengthy Do I Need SR-22 Insurance? If your insurance coverage gaps or obtains put on hold, the insurance company must inform the Division of Motor Automobiles (insurance). Sr-22 Information : Oregon Driver & Motor Vehicle Services - The Facts

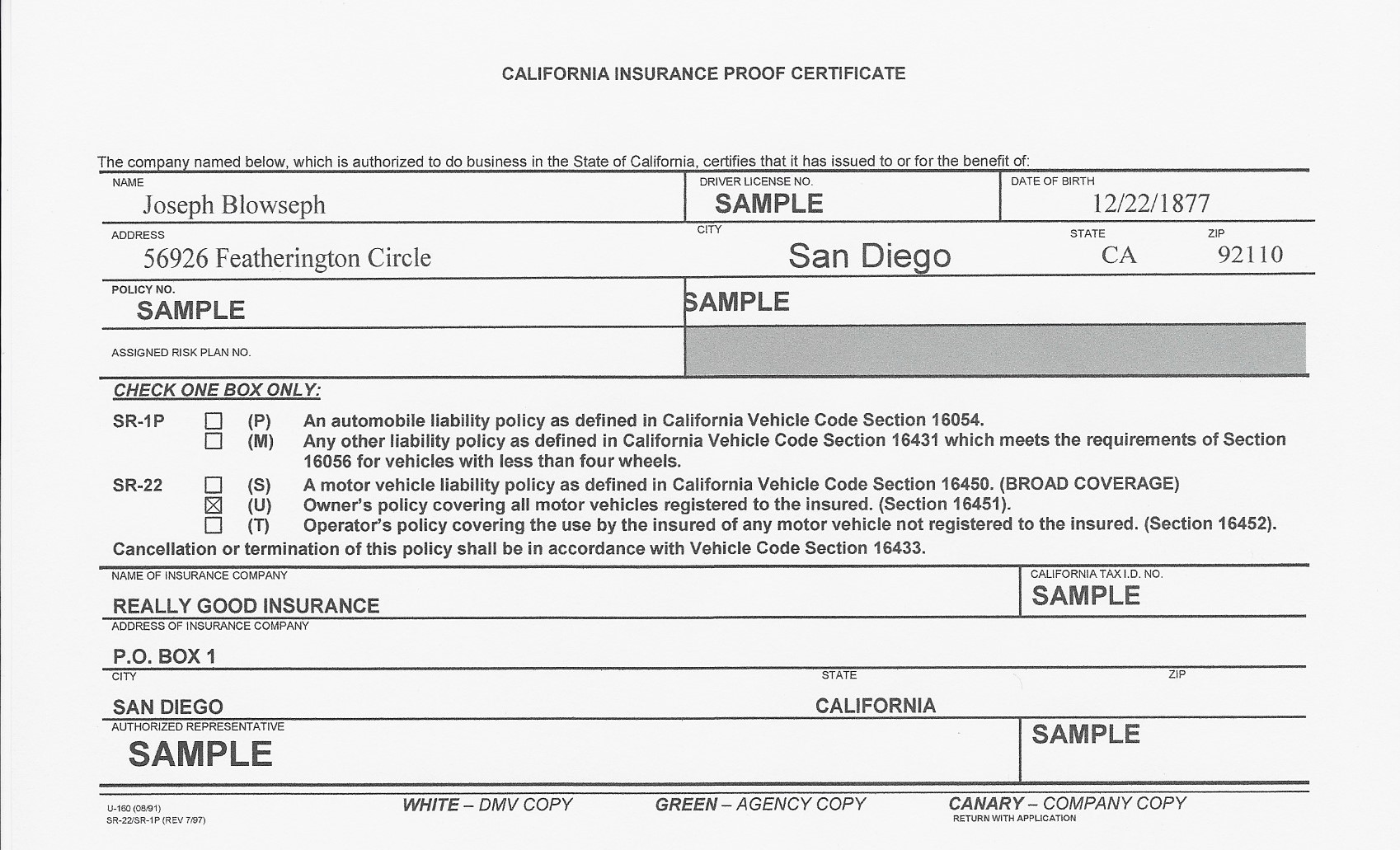

Get Aid with SR-22 Insurance Coverage Online Today If you need SR-22 insurance policy, you may really feel a little baffled. vehicle insurance. You can contact an insurance representative for help. If you're in trouble in California due to the fact that of being uninsured in an accident or getting a DUI, you could be required to prove you have car insurance with a type called an SR-22. An SR-22 is a certification, recognized as a California Insurance Coverage Proof Certification, that your insurer files with the California Department of Motor Automobiles - sr22 coverage.

See what you might conserve on auto insurance coverage, Quickly contrast personalized rates to see how much changing automobile insurance can save you. If you do not get an SR-22 after a significant violation, you might shed your driving privileges. Here's why you might require one and exactly how to find the most inexpensive insurance rates if you do. Just how to get an SR-22 in California, Filing an SR-22 isn't something you do by yourself. California calls for insurance firms to electronically report insurance policy info to the DMV.If you require an SR-22, ask your insurer to submit one in your place if it will. Some insurance coverage companies don't submit SR-22s (no-fault insurance). Existing Consumers can contact our Customer care Department at ( 877) 206-0215. We will review the insurance coverages on your plan as well as begin the process of submitting the certification on your part. Is there a fee related to an SR-22/ FR-44? Many states charge a level cost, however others need a surcharge. This is an one-time charge you have to pay when we file the SR-22/ FR-44.

A declaring fee is charged for each and every private SR-22/ FR-44 we submit. If your spouse is on your plan and both of you need an SR-22/ FR-44, after that the filing charge will be billed two times. Please note: The charge is not consisted of in the rate quote since the declaring cost can differ.

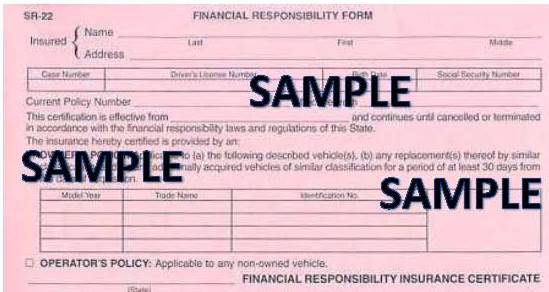

The length of time is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 must stand as long as your insurance plan is active. If your insurance plan is terminated while you're still required to lug an SR-22/ FR-44, we are called for to alert the correct state authorities. If you do not maintain continuous protection you can shed your driving advantages. The providing firm additionally has to have a power of attorney on documents in Illinois (sr22 coverage). The SR-22 should be submitted on an Economic Duty Certificate from the residence workplace of the insurance company (insurance). The SR-22 certificate is released in among the following types: Operator's Certification covers the vehicle driver in the procedure of any non-owned vehicle. Fascination About How Much Does Washington Sr22 Insurance Cost?

The sort of automobile should be detailed on the SR-22 or may be issued for all had vehicles. Operators-Owners Certification covers all cars possessed or non-owned by the motorist - insure. When payment is made to an insurance firm, the representative will send a demand for an SR-22 certificate to the home office. The person will get a duplicate of the SR-22 from the insurance provider and a letter from the Assistant of State's office. sr-22 insurance. The insurance coverage should be preserved for 3 years (insurance coverage). If the SR-22 runs out or is cancelled, the insurer is required by law to alert the Safety and security and also Economic Responsibility Area by a SR-26 Termination Certification - insurance. Out-of-state citizens may request their proof of economic responsibility for Illinois be forgoed by finishing an Testimony. The sworn statement applies only to Illinois' insurance policy needs. In case you relocate back to Illinois within 3 years from acceptance of the insurance policy waiver, your SR-22 need for Illinois would certainly be restored - liability insurance.

Although declaring fees are rather low, motorists who require SR-22 insurance policy will certainly find that their rates are extra expensive due to the drunk driving or other offense that caused the SR-22 need to begin with. How a lot does SR-22 price in California? SR-22 insurance in The golden state will cost greater than what you previously spent for auto insurance, however this is mostly due to the offense that caused you to need an SR-22 filing (division of motor vehicles). How How Much Is Sr22 Insurance In Florida - Campinghiking.net can Save You Time, Stress, and Money.

Whether your current insurance company will file an SR-22 for you, among the simplest ways to make sure you're obtaining one of the most inexpensive SR-22 insurance coverage is to compare quotes from numerous business. Many significant insurance companies in The golden state, including Progressive as well as Geico, will certainly file SR-22 types (vehicle insurance). Considering that every insurance firm examines your driving background according to its own requirements, we advise contrasting at the very least 3 quotes to guarantee you're getting the most effective prices. For example, a motorist with no-DUI history paying $100 monthly for automobile insurance might receive a 20% excellent driver discount and also only pay $80 each month. After getting a DUI, the chauffeur will be back to paying a minimum of $100 monthly, which is 25% more than the previous price cut price. coverage. Note that the SR-22 insurance coverage requires to list all automobiles you have or routinely drive - ignition interlock. How much time do you need to have an SR-22? The size of time you'll need to preserve SR-22 depends on your conviction, which must state for how long you're anticipated to preserve the SR-22 filing. dui. Preserving continual coverage is important - deductibles. Any gaps in your SR-22 car insurance policy will cause your driving benefits to be suspended once again, as your insurance firm would file an SR-26 form with the DMV informing them of the gap (insurance companies). If you relocate out of California during your compulsory declaring duration, you'll require to situate an insurer that does service in both states and also agrees to file the kind for you in the state. Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101 Things To Know Before You Buy

During the 10 years complying with a DRUNK DRIVING, you will not be eligible for a good chauffeur discount rate in The golden state. After this period has ended, the drunk driving will be eliminated from your driving document and also you will be eligible for the discount rate again. You might be able to get the sentence removed from your document earlier, yet as long as you stay with the very same insurance firm, the business will certainly understand concerning the DUI as well as remain to use it when determining your SR-22 insurance coverage rates. Yet it supplies insurance coverage if you occasionally drive other individuals's autos with their approval (sr22 insurance). For those that do not have an auto, non-owner SR-22 insurance coverage is a plan that offers the state-required liability insurance but is tied to you as the motorist, despite which vehicle you utilize. deductibles. Among the advantages of non-owner SR-22 insurance policy is that quotes are commonly more affordable than for a proprietor's policy, since you'll just get liability insurance coverage and also the insurance company assumes you drive much less regularly. Methodology To determine the average price of SR-22 insurance coverage in The golden state, we collected statewide ordinary rates from eight insurance providers: Mercury, Allstate, CSAA (AAA Nor, Cal), Farmers, Geico, Interinsurance Exchange (AAA So, Cal), State Ranch as well as United Automobile Insurance Policy Co. (UAIC). All quotes are for minimum insurance coverage plans for a 30-year-old man who is legitimately required to have his insurer submit an SR-22 on his part. driver's license. These prices were publicly sourced from insurance provider filings and also must be used for relative purposes only your very own quotes may be various. |

ArchivesCategories |

RSS Feed

RSS Feed